How To Download Income Tax Payment Challan

Challan sbi padasalai itds What is challan 280: download, types, verifying, income tax challan Income tax payment

Generate Professional Tax Challan & Payment Online in MP | How to Pay

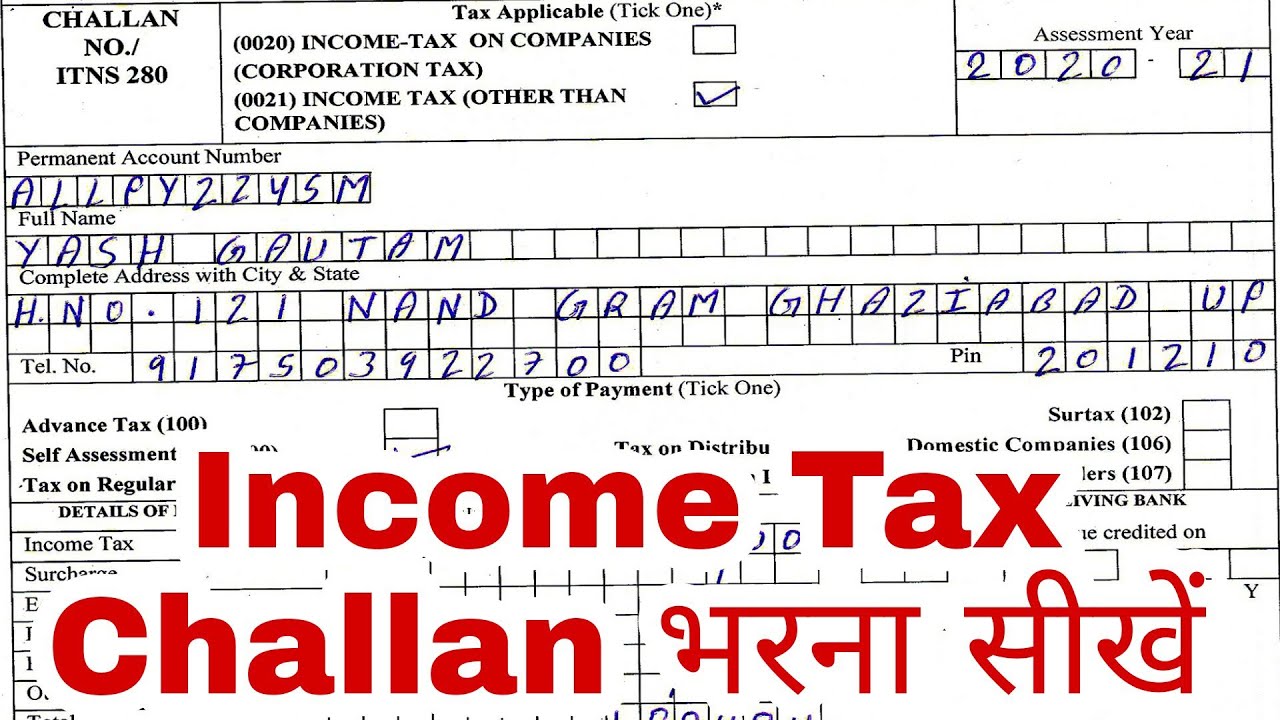

Create challan form crn user manual income tax department How to pay income tax offline Download automated excel based income tax deposit challan 280 fy 2019

Generate professional tax challan & payment online in mp

Tds challan 281 excel format fill out and sign printaHow to pay income tax online in 5 min ? use challan 280 How to make income-tax payments online ?Income tax challan fillable form printable forms free online.

Post office challan paymentChallan income Create challan form (crn) user manualHow can i pay my income tax online.

How to record income tax payments in tallyprime (payroll)

Challan taxHow to pay income tax online in 5 simple steps Tax income pay online challan steps simple offline alsoChallan payroll.

Online income tax payment challansIncome tax challan 280 fillable form Tax income online challan pay payment use receipt step pdf also getView challan no. & bsr code from the it portal : help center.

Tax income pay online challan india using hdfc basunivesh step

How to pay income tax challan online through icici bankHow to pay income tax online Recording income tax payments (payroll)Tax income step due pay guide challan entering personal information india.

How to fill income tax challan 280 offlineHow to payment tds through online part How to download income tax paid challan from icici bankIncome tax.

Free download tds challan 280 excel format for advance tax/ self

How to pay income tax online : credit card payment is recommended toTax payment over the counter user manual Challan tax jagoinvestor paying interest recieptChallan tds payment online 281 through.

Create challan form (crn) user manualHow to pay income tax online in india using challan 280? Tax payment over the counter user manualIncome tax.

Step-by-step guide on how to pay income tax that is due

Challan income payment receipt icici itr offline taxes code unableIncome tax payment challan (guide) .

.

Online Income Tax Payment Challans

How To Pay Income Tax Offline - TAX

Recording Income Tax Payments (Payroll)

how to payment tds through online part - 1 (Challan - 281) - YouTube

How can I pay my Income Tax Online

Income Tax - Bank Payment Challan - TTNEWS

Generate Professional Tax Challan & Payment Online in MP | How to Pay