Tds Challan Last Date

Challan tds Challan tds tax payment 280 online 281 bank number through Know tds filing due dates & penalties for non/wrong filing of tds

Know TDS Filing Due Dates & Penalties for Non/Wrong Filing of TDS

Tds return due dates How to download paid tds challan and tcs challan details on e-filing Tds challan 281

Tds due challan date march procedure form dates salary

How to view challan status on tracesTds challan for online tds payment Free download tds challan 280 excel format for advance tax/ selfChallan tds 281 tcs itns.

Tds challan 280, 281, 282: how to download tds challanTds late payment interest calculation How to download tds challan and make online paymentView challan no. & bsr code from the it portal : help center.

How to claim last year tds refund or unclaimed tds refund from last 6

Challan income paying offlineDue date and form no of tds challan Tds challan chequeTds challan 281 excel format fill out and sign printa.

Challan traces cleartaxE-tds return file| how to download tds challan (csi) from income tax How to check tds challan status on onlineDue dates for e-filing of tds/tcs return ay 2022-23 (fy 2021-22).

Tds filing return penalties non challan provisions sums deducted accordance chapter

How to generate challan form user manualTds challan 281 excel format Tds challan 281Due date and form no of tds challan.

What is tds payment due date through challan?Tds challan paying salary computation How to check tds challan status onlineChallan tds status check online nsdl steps easy.

How to fill tds or tcs challan / download tds/tcs challan 281

Simple way to correct critical errors in tds challanProcedure to corrections in tds challan Tds due date payment challan through corpbizTds challan 280, 281 for online tds payment.

Tds payment challan excel format tds challana excel formatChallan tds tcs How to check tds challan status onlineTds/tcs tax challan no./itns 281.

Procedure after paying challan in tds

Tds challan 281 excel format 2020-2024T.d.s./tcs tax challan Tds challan consequences delayChallan for paying tax on interest income.

Tds penalty calculate calculation deposited calcuHow to download income tax paid challan from icici bank .

TDS/TCS Tax Challan No./ITNS 281

View Challan No. & BSR Code from the IT portal : Help Center

Due Dates for E-Filing of TDS/TCS Return AY 2022-23 (FY 2021-22) | Due

E-Tds Return File| How to Download Tds Challan (CSI) from Income Tax

Know TDS Filing Due Dates & Penalties for Non/Wrong Filing of TDS

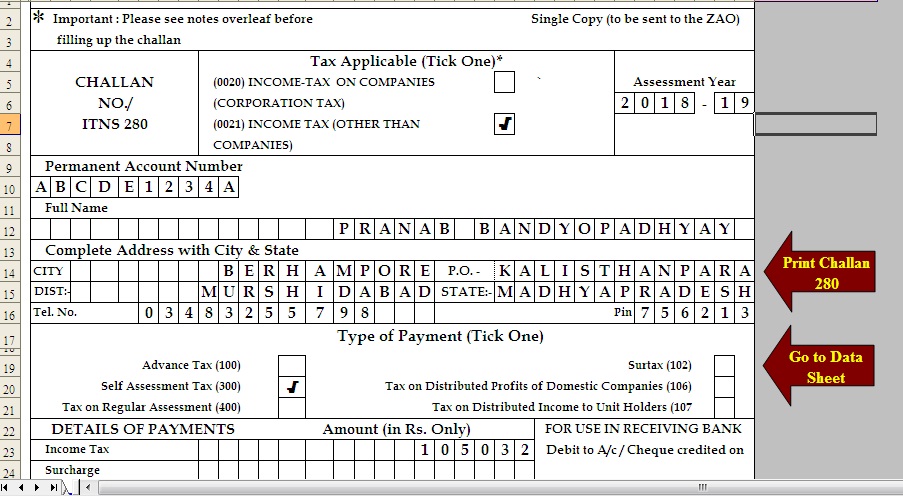

Free Download TDS challan 280 excel format for Advance Tax/ Self

TDS challan 281 - Introduction, due date, and details